Fun Tips About How To Protect Credit Score

Impact of coronavirus on credit scores.

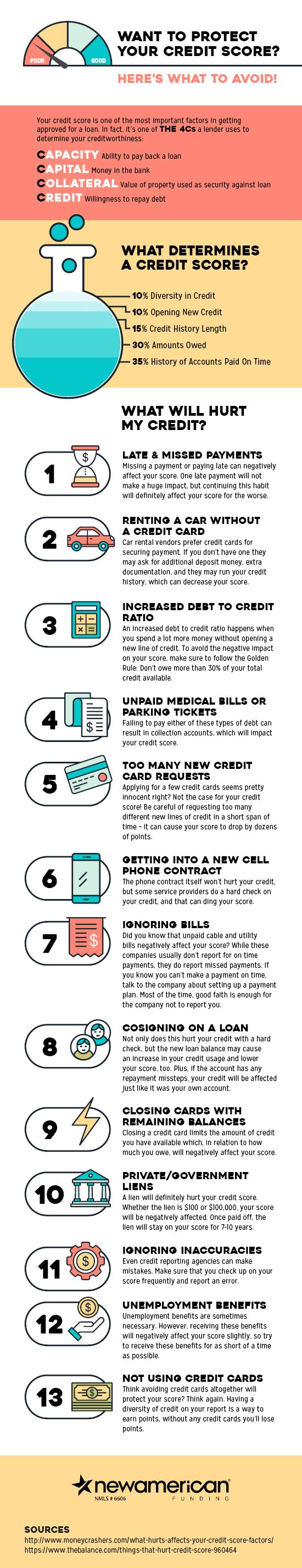

How to protect credit score. You’ll also know if your credit score has taken a sudden nosedive. Freezing your credit is a process that you can use to restrict access to your credit report, making it difficult for someone to open a new. Here are the ranges experian defines as poor, fair, good, very good and exceptional.

How to lock your credit report at experian. Understanding the importance of credit score. Credit monitoring services can provide you with early.

Pay down your revolving credit balances. Talk to a credit or housing counselor. Taking control of your finances is another fundamental step toward fixing your credit.

Develop a budget and stick to it. Here’s how to lock your credit at each of the three major credit bureaus: Find a credit score service.

Keeping your total balances as low as possible is crucial when managing your finances. Timely payments on credit cards and loans positively. Steps to protect credit score during coronavirus.

Your payment history carries significant weight in determining your credit score. From a credit score perspective, it’s also important to pay all of your other credit obligations on time. Pay all your bills on time.

Thieves use various methods to commit credit card fraud including application fraud, skimming and physical theft. There are four main ways to get your credit score: Not only will this help you avoid.

While you can still find apys as high as 5.5%, banks have been cutting rates across terms, and this trend is likely to continue as the fed is expected to start cutting. Remember, payment history is more influential over your. Keep your total balances as low as possible.

Find out how the tool works, and other ways to protect yourself against identity theft. If you have the funds to pay more than your minimum payment each month, you should do so. Experian launches tool to protect your credit score from potential scammers.

Be sure to monitor your credit card accounts, develop safe. Your payment history, which is one factor that makes up. This way, you’ll know whether any moves you’ve made (like paying down debt or disputing negative information) have boosted your score.