Unique Tips About How To Clean Up Your Credit File

Can you clean up credit report?

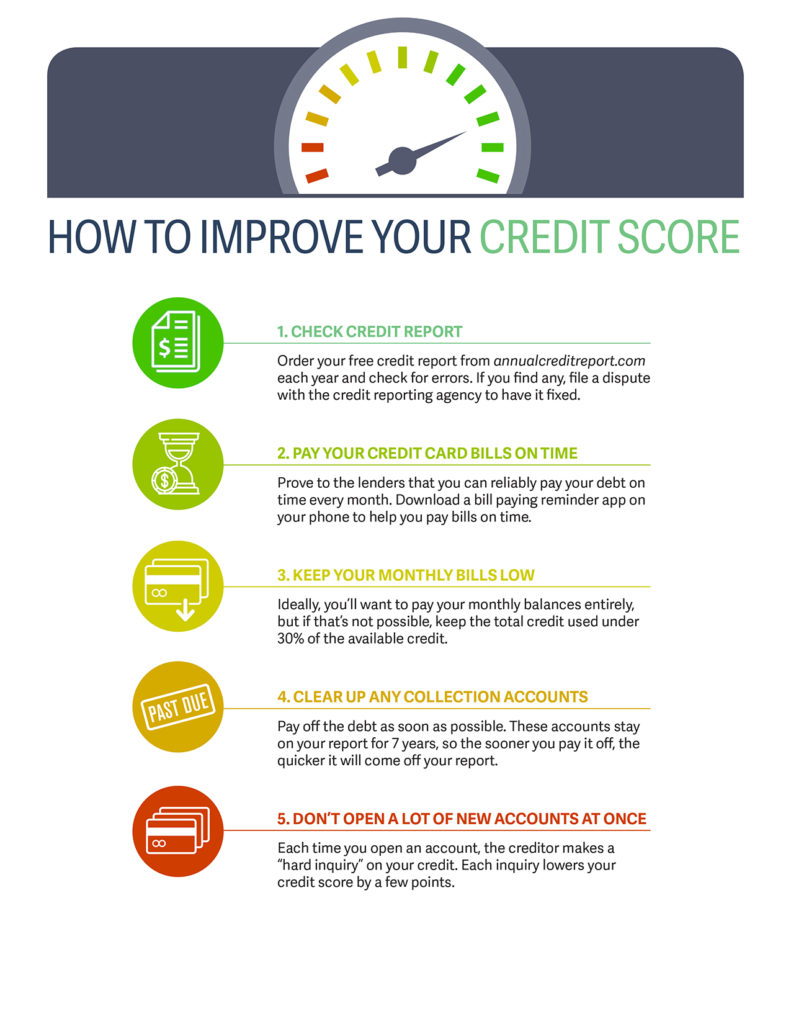

How to clean up your credit file. How to clean up your credit in 5 steps. Don’t fall prey to scams that offer to wipe your credit clean or fix your bad credit. Dispute the hard inquiry with the credit bureaus.

You have a right to get errors fixed for free, and. Pull your credit reports and obtain your credit scores. If you have a poor credit score or an error in your credit report, it may affect loans or credit you apply for.

It combines the perks of the existing google one premium plan, such as 2tb of extra storage, with access to google's most powerful model, gemini ultra, for the first. To clean up your credit reports, you'll need to get copies of your reports from the three major credit reporting agencies (or bureaus) and review the reports for inaccuracies or old. Everyone should consider requesting copies of their score at least once a.

Freeze or lift the freeze on your credit report for free by contacting each of the three major credit reporting agencies: How to fix bad credit. Is there a way to clean up your credit history?

Every hard search made by a lender when you submit a credit application will appear on your credit file. Loqbox helps you build up your credit score while saving money at the same time. If you have poor credit, you might want to clean up your credit report, but the only way to do this is to slowly improve your credit score, and it takes time.

If you’d rather not take out new credit, there are alternatives. You can receive free credit reports from each credit bureau on a weekly basis through april 20, 2022 by going to. The first step in cleaning up your credit reports is to know where you stand.

8 best credit repair companies. First, look for inaccurate information. We will talk you through your credit report over the phone and.

Protect your credit by checking your credit reports regularly for inaccurate. The fair credit reporting act entitles you to a free credit report from each credit bureau every 12. Fill out an enquiry form, or contact us directly on.

If you cannot get the creditor to remove the fraudulent hard inquiry, you can take your case to the credit.