Brilliant Info About How To Pay Off Credit Fast

This mountain of debt is one that just keeps growing, trapping many under impossibly high.

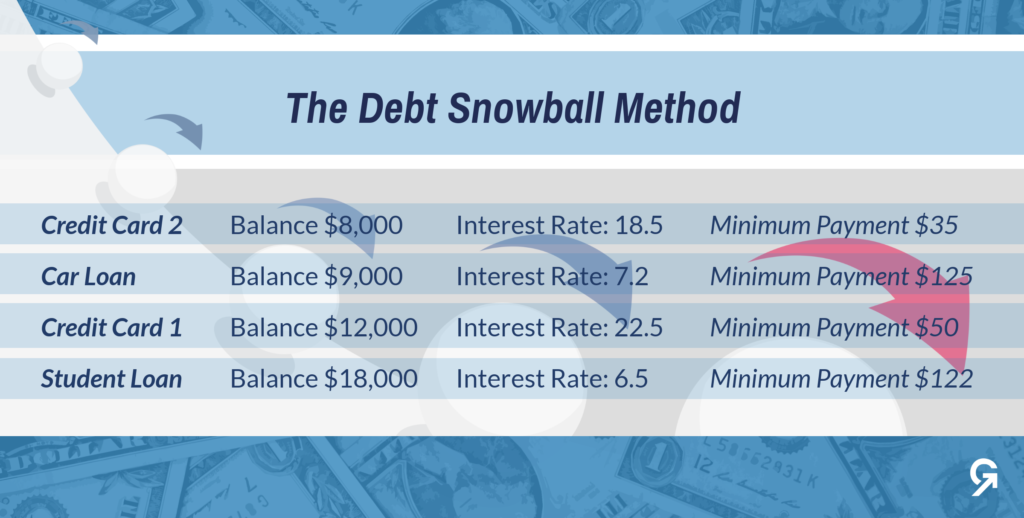

How to pay off credit fast. This credit card payoff calculator also recommends. How to improve credit fast. Two popular approaches are the debt snowball method and the debt avalanche method.

If you normally have trouble with impulse buying on credit, put the cards. Use wallethub’s credit card payoff calculator to calculate how long it will take to pay off a balance and how much it will cost. There are a number of ways you can pay off your credit card debt, including:

List all of your debt. Here are several techniques for paying off credit card debt the smart way. 19 is the first day you can file your taxes online and there are some key changes that will affect the tax filings of many people in canada.

Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances. How to improve credit fast. You could add up to 100 points with tips like paying cards more than once a month.

Wallethub senior researcher. Show pros, cons, and more. Make more than the minimum payment.

Assess your debt & make a plan. The best 3 ways to pay off credit cards fast include using the debt avalanche or the debt snowball. What are the best 3 ways to pay off credit card debt fast?

Almost 2 in 5 americans with credit cards (38%) say they don’t know all the interest rates on their. If your minimum payment is 3%, you'll take a little over 25 years to pay off your balance. The first step to solving any problem is to acknowledge it fully.

The best way to pay off credit card debt is as soon as possible. Housing may be the largest expense you grapple with every month. Taking control of your finances is another fundamental step toward fixing your credit.

Develop a budget and stick to it. This is an obvious one, but also not a universal suggestion. At that rate, you’re mostly paying off.

How to pay off debt fast: With the snowball method you’ll pay off the card with the smallest. Certain techniques — such as balance transfers, automated savings, painless spending cuts and the snowball method — can help you tackle your debt with a.