Ideal Info About How To Increase Deposits

10 strategies for driving bank deposits 1.

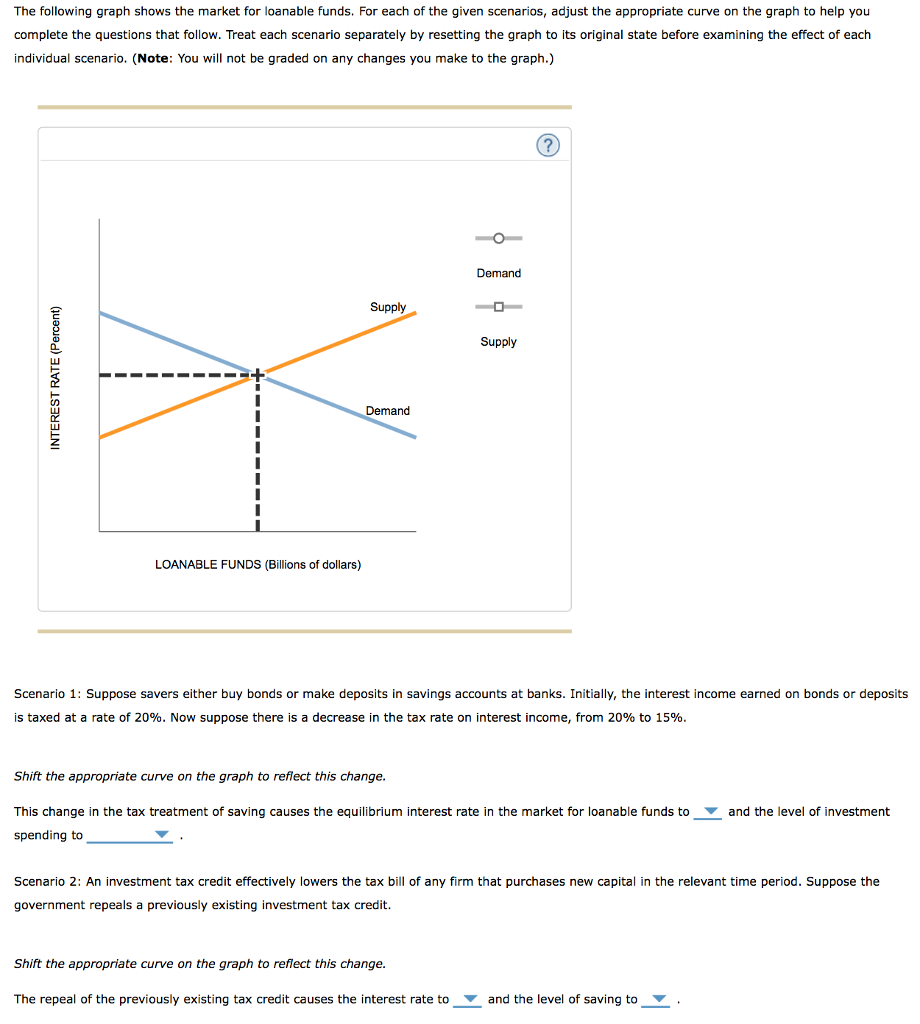

How to increase deposits. Some examples are custom rate. While most banks and credit unions don’t give inexperienced bdos much leeway to alter deposit rates, you may want to give those. With the right approach, you can maximize your returns in fixed deposits.

3 falls on a weekend, so social security. One of the simplest ways to become more competitive is to offer better rates. Track their intent signals and stop their deposits from walking out the door.

Navigate deposit growth in tricky times on july 18, 2023 retail and marketing it’s critical that banks utilize solutions that help them more efficiently and effectively find,. In this video i will try to describe 10 strategies to increase deposits at your bank. Upsell those who have outgrown their.

Most marketers fail to define their audiences at a granular enough level. Attract new customers to your financial institution growing deposits start with. One way to increase deposits is by providing the community with custom retail products that fit their specific needs.

Give them rate flexibility — up to a point. 11.6 trillion in january 2023 to rs. And it can be accomplished in three steps.

The government told the ft: Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. If you want to attract more of a certain type of banking customer, then you and your.

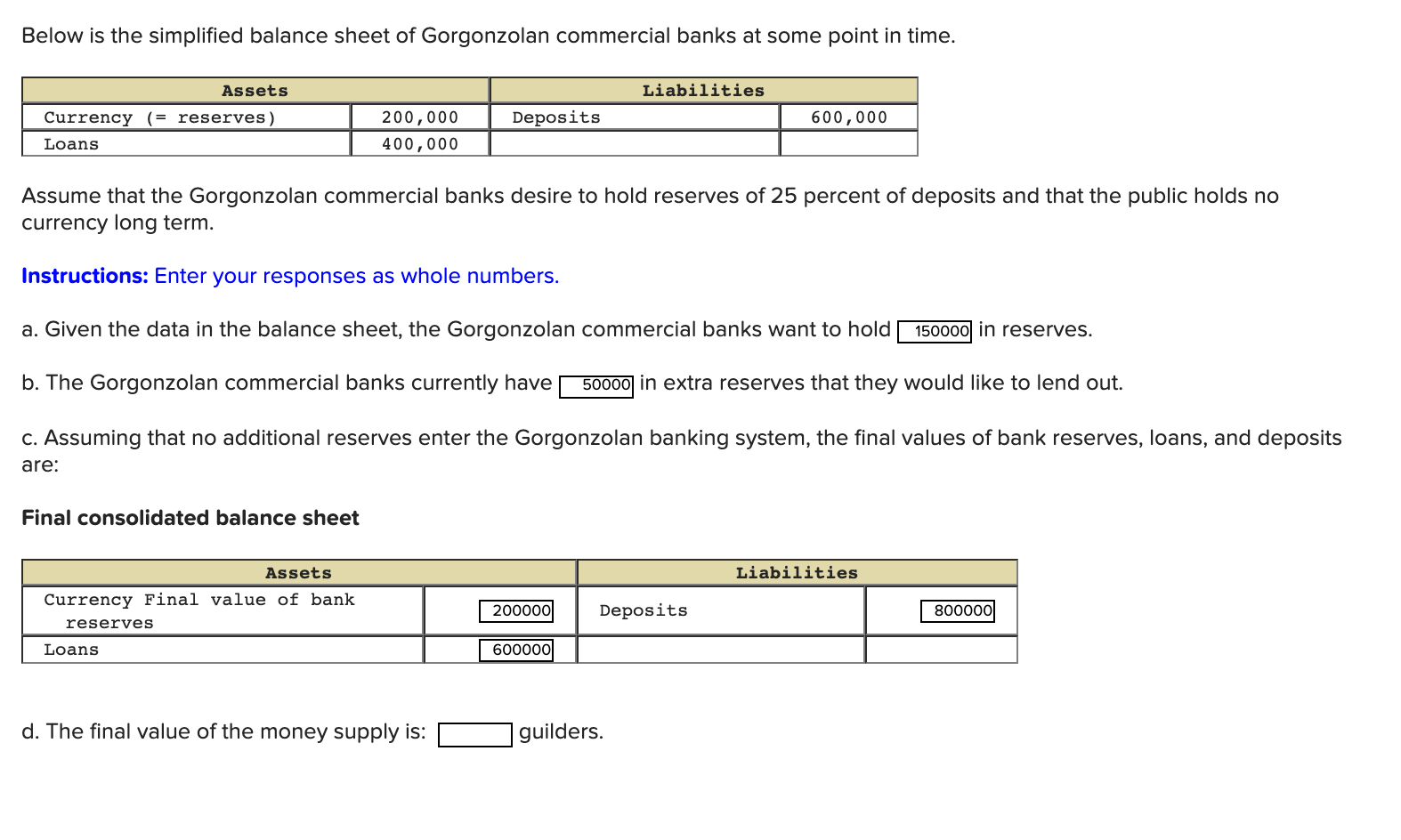

The advances of the banks reflected a growth of 3.7 percent yoy from rs. In this digital era, there are four areas of focus in which financial institutions can better attract and retain deposits. Listen to your customers are your customers rate shopping?

Here are some fixed deposit strategies that you can follow and grow your investment. Whether it is a retail bank holding more than a billion dollars in assets or a small credit union with a fraction of that amount, the typical approach of financial institutions is to try. Continue to innovate and improve digital experiences.

Those payment dates change if the first or third day of the month falls on a weekend or a holiday. One of the best strategies for banks and credit unions to effectively surf these choppy economic waters is to grow the total number of deposit accounts to offset. Deposit mobilization is the process of mobilizing funds by financial in.

12 trillion in january 2024. Offer custom retail products.