Best Of The Best Info About How To Handle Creditor Calls

Keep a record of all communications you have with the collection agency.

How to handle creditor calls. They will call you, leave messages, and send you letters and notices. Learn more about the laws that limit what debt collectors can say or do First, decide if you want to talk to the collector.

Once you miss even one payment on a credit card or have a medical bill sent to collections, you'll start hearing from creditors. Yet it's a fairly common occurrence. Keeping record of your contact with a debt collector.

Telling them over the phone isn’t enough. Tell them that you want them to stop contacting you. If you’re being hounded by a debt collector, it’s important to know how to handle the situation.

Guido mieth / getty images answering a call from a debt collector can throw your day off track with the new responsibility of resolving a financial issue. It’s important that you verify that the debt is accurate. Don't give in to pressure to pay on first contact just as you wouldn’t jump into a contract without understanding its terms, don’t rush to make a.

Make sure the debt collector is legitimate. What to do when a debt collector calls frequently asked questions (faqs) photo: You must send a letter, preferably via certified mail with a return receipt request.

October 21, 2019 by guardian litigation group prev post next post at their best, debt collectors and their practices can be annoying. The great thing about handling creditor calls… is that we tell you just to forward them to us. You might consider telling the collector if you think.

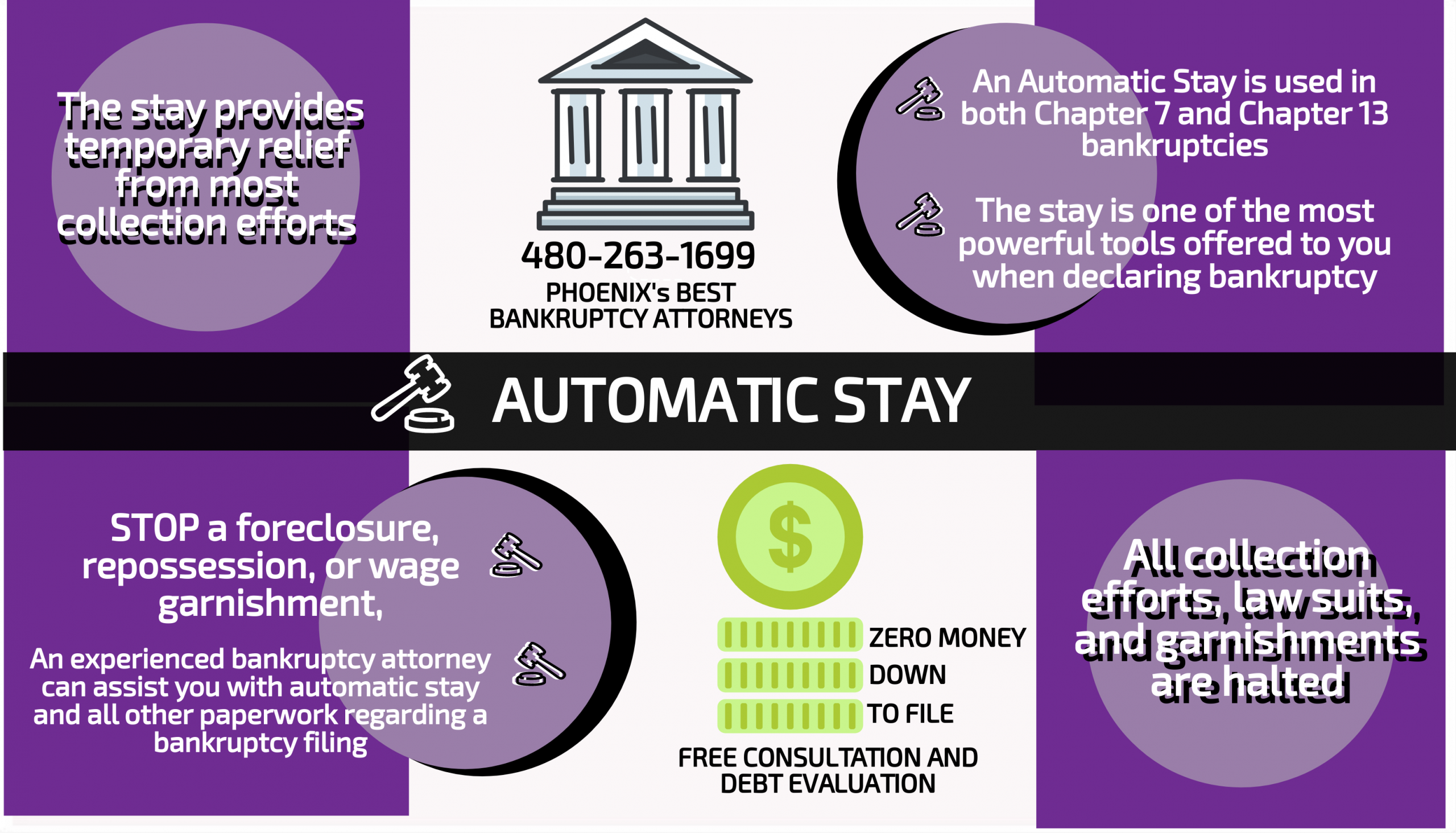

With a few exceptions, the automatic stay stops creditors from trying to collect debts from the bankruptcy filer while their case is pending. Once you’re sure you paid the debt, the easiest way to stop debt collector calls is to send a cease and desist letter that simply requests the debt collector to stop contacting you. Creditors can’t contact you after you file because of the automatic stay.

For example, if the debt collector is calling you at an inconvenient time or place, you have the right to ask the debt collector to call you at a more convenient time or place you specify. If so, keep a record of what you and the collector discuss. At their absolute worst, they could be predatory or even illegal.

Each province has exact rules governing what collectors can and cannot do. If you’re being contacted by a debt collector, it’s important to keep a record of any letters, documents, or communications they send to you. According to the fair debt collections practices act (fdcpa), debt collectors can’t do the following:

The information the collector shares must include the original creditor’s name and contact information, the amount of the debt, when the last payment was made and what you can do to dispute the. What can a debt collector do? Creditors calling at work | know your rights generally speaking, collectors cannot call you at all hours of the day and night, nor can they keep calling your place of employment to confirm your employment status.