Painstaking Lessons Of Info About How To Check Ca Tax Refund

File a return, make a payment, or check your refund.

How to check ca tax refund. The process of filing a claim: Numbers in mailing address up to 6 numbers; Check your refund status.

Zip code 5 numbers only; The taxes and benefits for indigenous peoples webpage offers information about tax filing, as well as benefits and. Where's my refund shows your refund status:

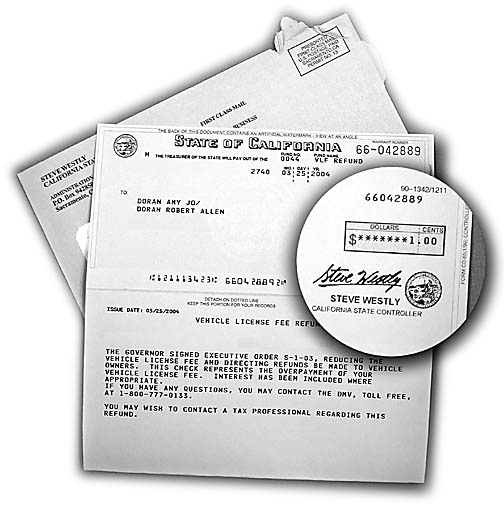

Filing status the exact whole dollar amount of your refund use the irs where's my refund tool or the irs2go mobile app to check your refund online. Franchise tax board (ftb) you may be able to get a tax refund if you’ve paid too much tax. However, families taking certain credits for the 2023 tax year will have.

Before you start what you'll need: Check how to claim a tax refund. California franchise tax board.

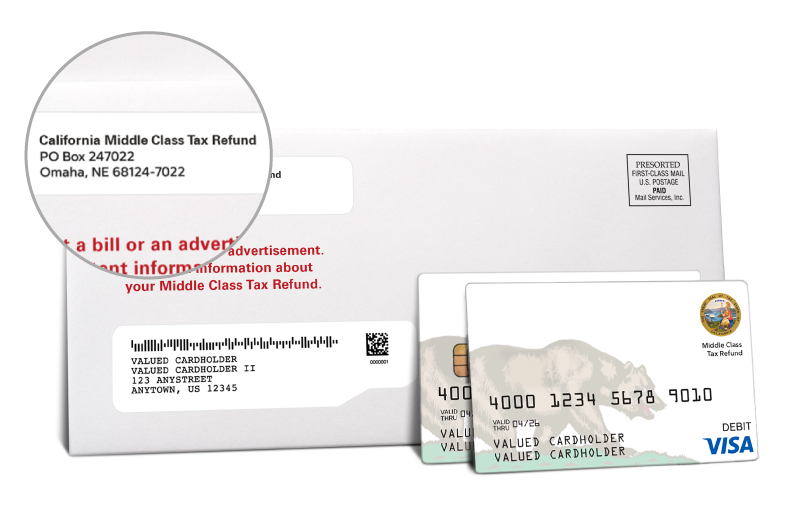

The irs updates the tool’s refund status daily. You can check the status of your. Do not disclose card details unless.

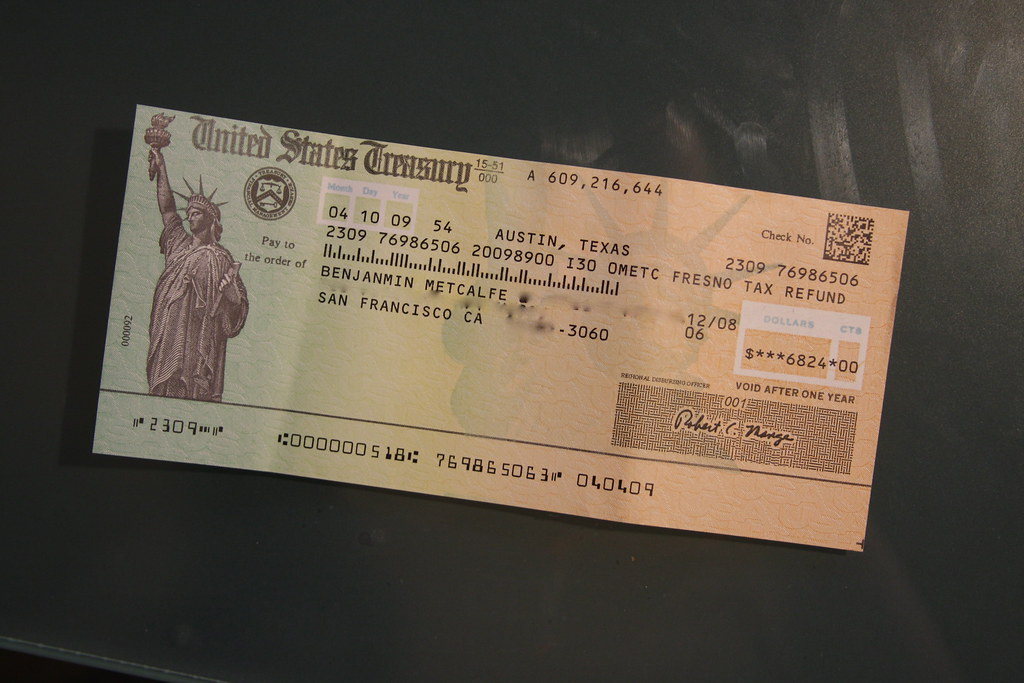

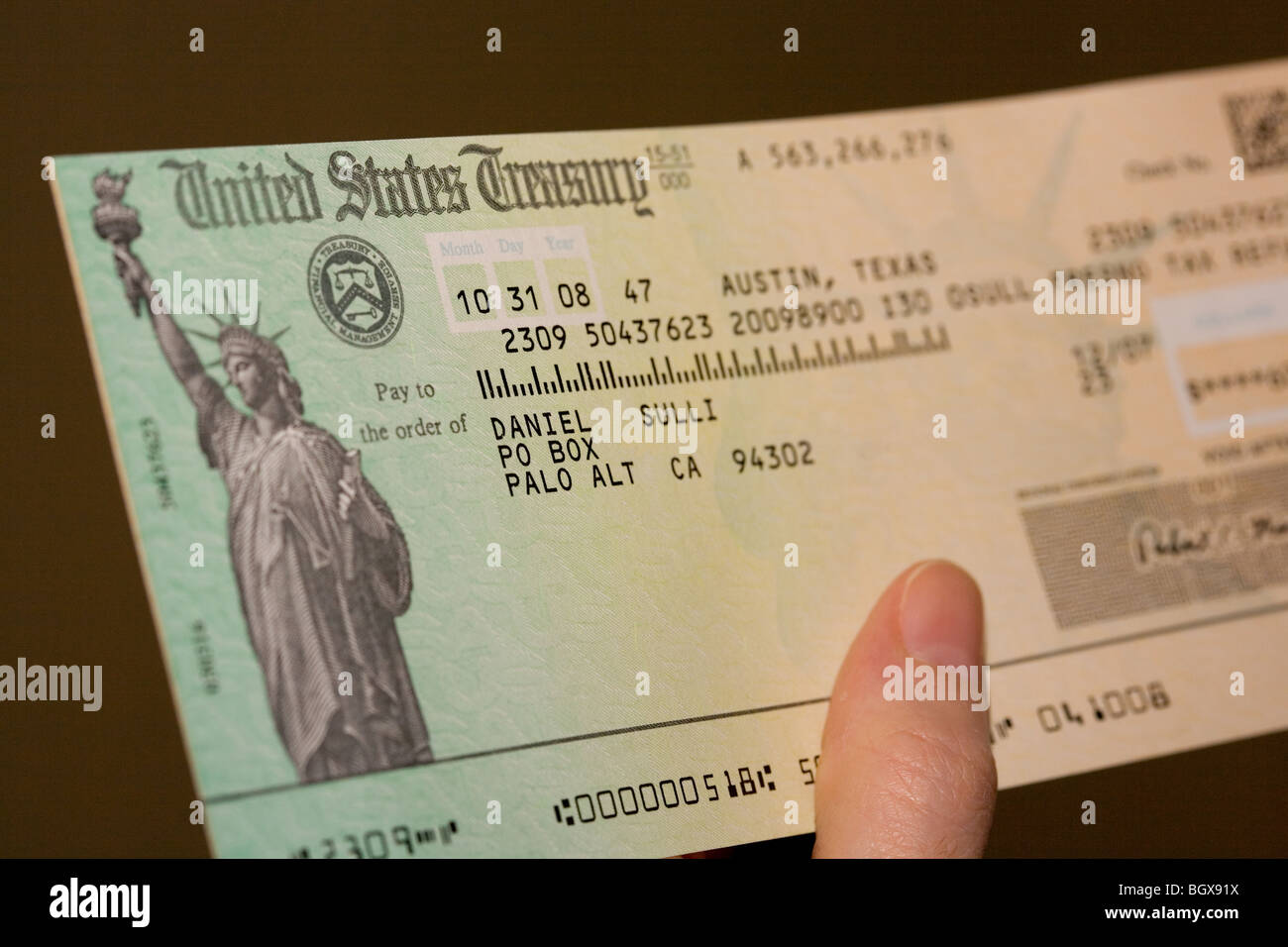

If you chose direct deposit, the money should land in your account within five days from the date the irs approves your refund. The following will receive their payment by mail in the form of a debit card: Social security number numbers from your address (if you have numbers in your address) zip code.

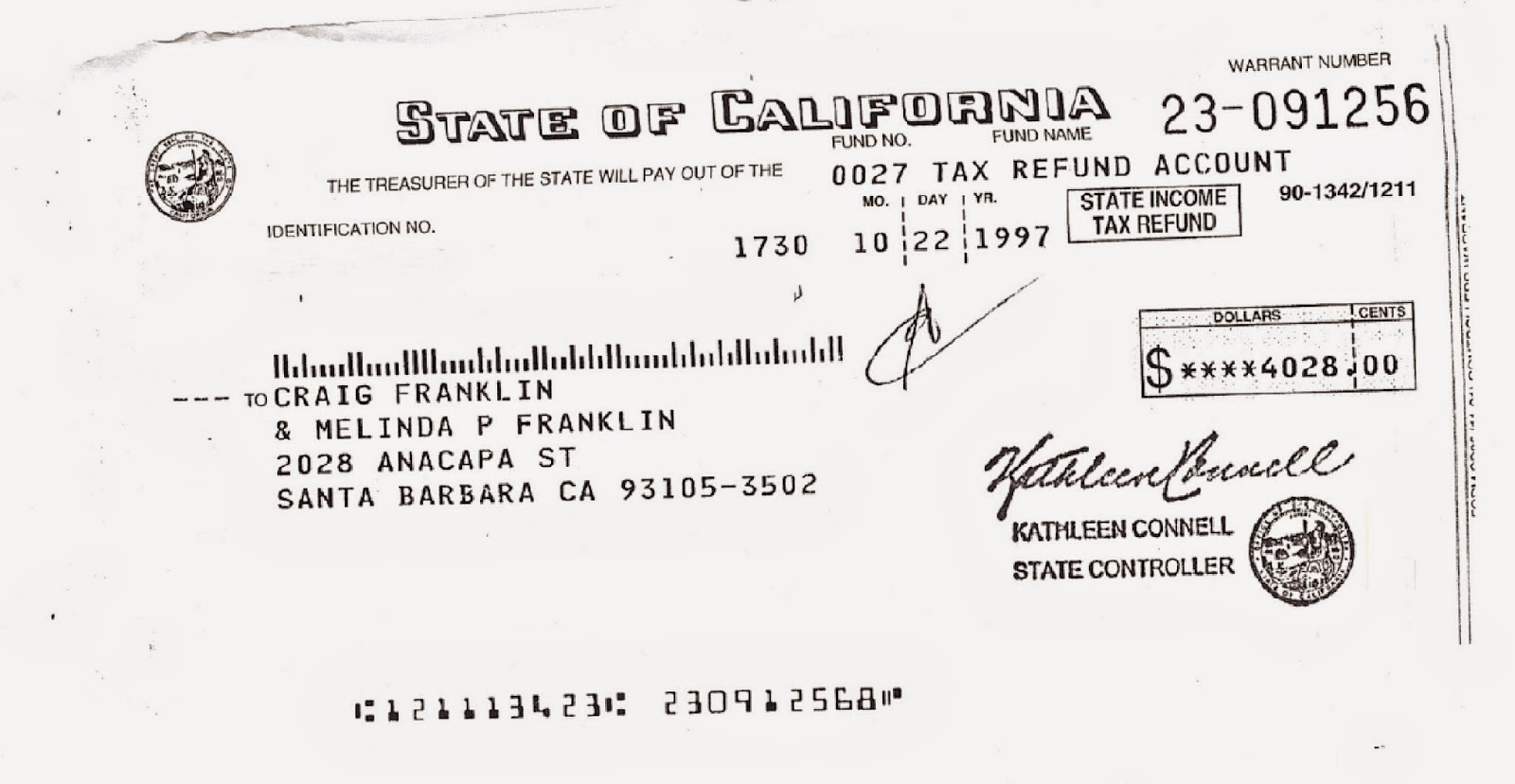

Be cautious when sharing your password, pin, social security number, or individual taxpayer identification number (itin). Received your tax refund by check regardless of filing method received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number * social security number 9 numbers, no dashes.

Use this service to check your refund status. To check your refund status through the ftb, you’ll need your social security number, zip code, exact refund amount. The systems are updated once every 24 hours.

Check your 2023 refund status. Last year, there were more than 18 million refunds processed. Check your refund.

Check the status of your refund Social security number zip code your exact refund amount. Recipients must have filed their 2020 tax return by oct.