Perfect Tips About How To Buy Income Property

In some cases it can be adjusted upward if you also spend money increasing that asset’s value.

How to buy income property. But the rewards don’t come without some. For most people, a home is the biggest purchase they will ever make. Buying investment property and acting as a landlord can be a good way to earn income, but requires a commitment of time and money.

House hacking is the easiest way to buy your first rental property. And if you want a part of the glory, you’re. Cost basis is the amount that you pay to buy an asset.

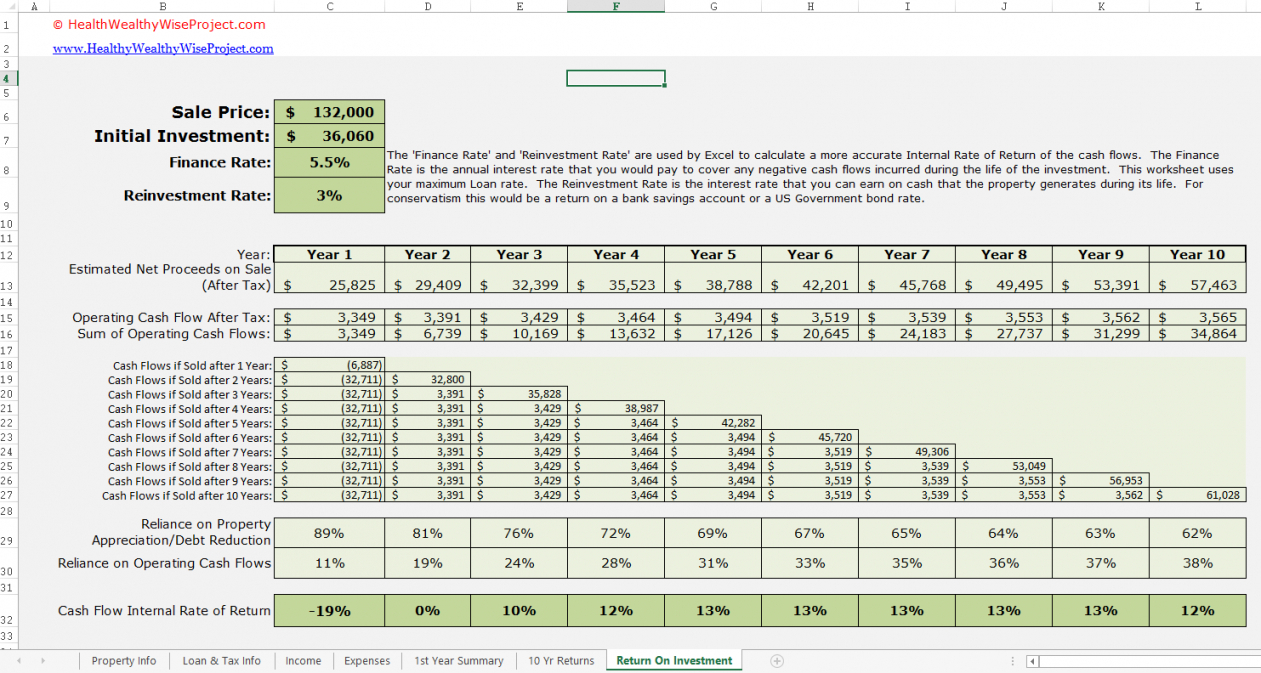

Investing in real estate (specifically income properties) has been one of the best career changers for people all around. Buying an income property isn’t that different from buying a primary residence: Before signing off on the deal, you’ll want to calculate your potential return on investment.

An investment property is real estate purchased to generate passive income (earn a return on the investment) through rental income or appreciation. So, if you’re planning to buy one to generate rental property income later, you need to. According to a 2023 gobankingrates survey, 18% of.

Before buying an income property make sure you are ready to handle the responsibility of being a landlord. Estimate annual rental income—including rent and additional income like storage fees or pet rent. If you've decided to buy an investment property outright, as opposed to passively invest via crowdfunding and real estate investment trusts (reits), here are.

If the net annual income is $7,500 and you spent $100,000 on. You just have to provide your lender with a lot more information. The scheme, which is being debated in parliament this week, will allow 40,000 australians to buy a home with just a 2 per cent deposit if they earn $90,000 as a single.

When you find your ideal rental property, keep your expectations realistic. Simply divide the property’s total annual cash flow by your cash investment. Using a credit card to buy a rental property can be quite risky due to the high interest rates and potential for mounting debt.

Buying an income property can be a lucrative way to make money in real estate and diversify your investment portfolio. Get your finances in order. Andrey_popov / shutterstock.com.

A 5% yield on this portfolio would generate passive income of $36,250. To find the roi, take the annual income and divide it by the amount you spent on the property. And in the bargain, you score free housing!

Rental income properties don’t come cheap. To calculate the roi of a property, an investor needs to:

![[Podcast] The most effective property strategy for now and an update on](https://cdn.propertyupdate.com.au/wp-content/uploads/2020/08/home-money-property-scaled.jpg)